Most people are aware of the Woke antics of companies like Anheuser-Busch (makers of Bud Light), Netfix, and Target. When they’re not pushing the homosexual agenda, they’re peddling the transsexual agenda, or they’re promoting an anti-white agenda.

Most people are aware of the Woke antics of companies like Anheuser-Busch (makers of Bud Light), Netfix, and Target. When they’re not pushing the homosexual agenda, they’re peddling the transsexual agenda, or they’re promoting an anti-white agenda.

How often nowadays do you see advertisements which include homosexuals, transsexuals, a disproportionate amount of non-whites, or a disproportionate number of bi-racial couples? What percentage of judges on TV are black? How many new shows on Netflix don’t include a homo or a tranny?

What is driving all of this Woke propaganda on TV? Why are capitalist companies engaging in Leftist social campaigns? The short answer is that most of the people in management positions in all of these industries have all been brainwashed in Leftist-dominated universities, but there is far more to the story than that.

This is a tale of a small number of Cosmopolitan advocates in highly influential capitalist companies, and what they did to push their social-political agenda, and how they then bullied others to kowtow to their Woke revolution.

Business Roundtable

In 2019 a meeting was held of the Business Roundtable, a group of CEOs from the biggest companies in the USA. They discussed their personal beliefs and their shared goals of “diversity and inclusion”, as part of their aim to spread their Cosmopolitan ideology around the world.

The Business Roundtable group issued a manifesto, which they called a “Statement on the Purpose of a Corporation”, and which contained their demand that all companies should “share a fundamental commitment to all of our stakeholders” to encourage and promote what they deemed to be the larger social good.[1]

The statement was signed by almost 200 corporate representatives, including leaders of top-ranking companies, such as Amazon, American Airlines, American Express, Apple, AT&T, Bank of America, Bayer, Best Buy, BlackRock, Boeing, BP, Caterpillar, Chevron, Chubb, Citigroup, Coca-Cola, Comcast, Dell, Deloitte, Dow, Exxon Mobil, FedEx, Ford, Fox, General Dynamics, General Motors, Goldman Sachs, Hearst, Home Depot, Honeywell, IBM, John Deere, Johnson& Johnson, JP Morgan Chase, KPMG, Lockheed Martin, Macy’s, Marathon Oil, Marriott International, Mastercard, Motorola, Nasdaq, PepsiCo, Pfizer, Procter & Gamble, Qualcomm, Siemens, Stanley Black& Decker, Target, Texas Instruments, Union Pacific, United Airlines, UPS, Visa, Walmart, Western Union, Whirlpool, Xerox, and many more.[2]

At a quick glance, their statement looks fairly innocuous, but the devil is in the detail, as well as in the practical application of a scheme. Their manifesto announced “We foster diversity and inclusion” — which sounds nice, and very caring and sharing of them — but what does that little phrase mean, exactly?[3]

Well, out in the corporate world, where so many business leaders have graduated from Leftist-dominated universities (having been steadily brainwashed for years by neo-Communist teachers), “diversity and inclusion” is all about including a diversity of types who would be most likely to help push a Leftist agenda and aid in creating a Leftist social narrative, especially in the areas of ethnicity and sexuality.

In this context, “diversity” means hiring and promoting homosexuals, transsexuals, blacks, Asians, Indians, etc.; it also means the hiring and promoting of Leftist Feminists, who can be guaranteed to push the Woke agenda in the corporate workplace. The reverse side of the coin is that “diversity” means hiring as few white people as possible, especially white males; and they certainly don’t want to hire people with conservative views and values. As always, “diversity” is code for “anti-white” (or “anti-white racism”, to be more specific).

The following year, the Business Roundtable website admitted that their manifesto was the overturning of a viewpoint which regarded “a corporation’s principal purpose as maximizing shareholder return”. As an example of this new direction, Kevin Sneader, Global Managing Partner of McKinsey & Company, reported that their commitment influenced their response to “the effort to promote and deliver racial equity and justice, and the need to act on climate change and the environment”. Big businesses had committed themselves to fundamental elements of Leftist socio-political ideology.[4]

The Business Roundtable website opines about “advancing diversity, equity and inclusion”, “a need to bolster our focus on underrepresented populations to ensure equitable hiring, promotion and compensation practices”, and “public disclosure of key diversity metrics on at least an annual basis, including board diversity, senior executive diversity, workforce diversity and supplier diversity”.[5]

They also publish diatribes from their Woke companies on what they are doing to push their “diversity” goals. For example:

Coca-Cola: “As a company that believes diversity and inclusion are among our greatest strengths, we must put our resources and energy toward helping advance equitable workplaces and end the cycle of systemic racism. … Diversity, equity and inclusion are at the heart of our values … to mirror the diversity of the communities where we operate”.

Ford: “To date we have sourced $161 billion in goods and services with diverse-owned businesses, and our program includes several certifications that emphasize our commitment to DEI. … Ford Marketing creates efforts to build the experience of Black, Hispanic and Women consumers … $1 million in grants to Black and Latina entrepreneurs.”

Microsoft: “Microsoft is committed to addressing racial injustice and inequity for the Black and African American community in the United States. We will additionally take steps to address the needs of other communities, including the Hispanic and Latinx community … We will build on our diversity and inclusion momentum by adding $150M of investment, and will double the number of Black and African American people managers, senior individual contributors, and senior leaders in the United States by 2025. … We will use the power of data, technology, and partnership to help improve the lives of Black and African American citizens across our country.”

Paypal: “We embrace a diverse workforce that includes people of different ethnic and cultural backgrounds, gender identity and expression, sexual orientation … Our diversity data is a critical measure for how we assess our performance in building a truly inclusive workforce throughout all parts of the company. We report on our diversity numbers in our annual Global Impact Report … We recognize and partner with certified minority-owned, women-owned, veteran and service disabled-owned, LGBTQ+ and disability-owned businesses … we believe we have a unique opportunity and responsibility to do our part in closing the racial wealth gap”.

Walmart: “We remain focused on building teams that are diverse and inclusive … Walmart and the Walmart Foundation pledged to contribute $100 million over five years through a Center for Racial Equity to help address racial disparities in the U.S.”.[6]

If you wanted to find any programmes of funds specifically set up to help poor white communities, you’d be hard-pressed to find one. It’s almost as if all of these Woke corporations are anti-white. Who would have thought it?

The Business Roundtable site also says “Business Roundtable CEOs are also identifying and actively supporting key policy changes that would advance racial equity and close racial disparities … Business Roundtable CEOs recognize the need to bolster their focus on underrepresented populations to ensure equitable hiring, promotion and compensation practices. This includes stepping up to the challenge of advancing diversity and inclusion in corporate America.”[7]

What they’re really talking about here is anti-white discrimination and anti-white racism. No longer is it a case of the best person for the job, but rather the best non-white person available who will help them meet their “racial diversity” targets.

The cosmopolitan agenda in capitalism

Larry Fink, CEO of BlackRock, was already pushing things in this direction before the issuing of the 2019 manifesto. Indeed, one has to wonder what sort of role Fink played in the creation of the Business Roundtable manifesto. Was Fink, CEO of one of the biggest corporations in the world, just a bystander? Or was he was one of the main influences behind it?

In 2018 Fink issued a letter to corporate CEOs, demanding “that companies, both public and private, serve a social purpose”. He also said “In the $1.7 trillion in active funds we manage, BlackRock can choose to sell the securities of a company if we are doubtful about its strategic direction” (a statement which some viewed as a thinly-veiled threat). Fink then went on to insist that companies address issues of diversity and environmentalism, and stated that he was linking ESG issues with BlackRock’s investment process, saying “We also will continue to emphasize the importance of a diverse board. Boards with a diverse mix of genders, ethnicities, career experiences, and ways of thinking … a company’s ability to manage environmental, social, and governance matters demonstrates the leadership and good governance that is so essential to sustainable growth, which is why we are increasingly integrating these issues into our investment process. … Companies must ask themselves: What role do we play in the community? How are we managing our impact on the environment? Are we working to create a diverse workforce?”[8]

The New York Times noted that many company leaders were “taking stands on issues like immigration policy, race relations, gay rights and more” and that Fink planned “to hold companies accountable” and was “adding staff to help monitor how companies respond”. The NY Times gave details of how BlackRock was helping Leftist activist investors in their fights within companies. It was also noted that Fink had the financial clout to demand that companies comply with his directions, as BlackRock controlled “$6 trillion in investments through 401(k) plans, exchange-traded funds and mutual funds, making it the largest investor in the world”, and that he could wield a sizeable influence over which directors could be voted on or off company boards.[9]

Affirming Fink’s Leftist credentials, the Australian Financial Review reported that “Mr Fink is considered a Wall Street Democrat who supported Hillary Clinton against Mr Trump in the 2016 presidential election”.[10]

Alan Murray traces the roots of this new corporate manifesto to leading figures in the corporate world who have been campaigning for a new type of capitalism. Bill Gates (of Microsoft) called for “creative capitalism” (2008); John Mackey (of Whole Foods) wanted “conscious capitalism”; Marc Benioff (CEO of Salesforce) wrote about “compassionate capitalism”; and Lynn Forester de Rothschild (CEO of E.L. Rothschild) agitated for “inclusive capitalism”.

Murray also reveals that, in December 2016, after Donald Trump won the Presidential election, Fortune magazine organised a meeting in Rome of 100 CEOs to discuss “how the private sector could address global social problems”. He also notes instances of CEO activists taking public stands on issues such as homosexuality and “transgender access to public bathrooms”.[11]

However, Murray didn’t address the underlying reason why so many CEOs have become corporate Social Justice Warriors. The answer to that lies in two areas.

Firstly, in the brainwashing carried out by Leftist teachers, who now predominate in kindergartens, primary schools, secondary schools, and universities (with so many Conservative teachers being sacked or driven away from the education system, the few who are left tend to keep their heads down and keep their opinions to themselves).

Secondly, in the continual brainwashing pushed by the mainstream media, which has been steadily drip-feeding Leftist propaganda through the mediums of entertainment and news for decades.

Since the education and entertainment industries have been dominated by the Left since at least the 1970s, this means that at least two generations of managers and executives have been educated, brainwashed, and churned out as Leftist drones.

The Big Three and ESG

Environmental, social, and corporate governance, or ESG, was developed as a framework for incorporating political and social Lefist ideology into business plans and structures. The wording of the ESG plans may sound benign on paper, but in real life they equate to siding with sexual degeneracy, climate change alarmism, racial quotas, and anti-white racism.[12]

Investopedia says that “Adopting ESG principles means that corporate strategy focuses on the three pillars of the environment, social, and governance. This means taking measures to lower pollution, CO2 output, and reduce waste. It also means having a diverse and inclusive workforce, at the entry-level and all the way up to the board of directors.” However, it does acknowledge that “ESG may be costly and time-consuming to undertake”.[13]

ESG has even been included in legislation, making it even more of an insidious fifth column tactic in the business world.

An article from FX Empire tells us that “As European legislation includes more ESG (Environmental, Social, and Governance) or sustainable factors and there is an increasing number of funds on offer, the trend is set to continue. Even a recent World Bank report stated that incorporating ESG into fixed income investments should be part of the overall credit risk analysis and should contribute to more stable financial returns.”

Francis Menassa, of JAR Capital, says “the EU’s 2014 Non-Financial Reporting Directive … will apply to every country on a national level to implement and requires large companies to disclose non-financial and diversity information. This also includes providing information on how they operate and manage social and environmental challenges. The aim is to help investors, consumers, policy makers, and other stakeholders to evaluate the non-financial performance of large companies.”[14]

To reiterate, the European Union is demanding that companies provide “non-financial and diversity information” — this is Orwellian politics at a whole new level.

According to an article published in McKinsey Quarterly (from McKinsey & Company), “More than 90 percent of S&P 500 companies now publish ESG reports in some form, as do approximately 70 percent of Russell 1000 companies. In a number of jurisdictions, reporting ESG elements is either mandatory or under active consideration.”[15]

It has also been reported that “Globally, ESG investments now account for more than 25 per cent of the world’s professionally managed assets – and rising.”[16]

However, despite the inroads that this Leftist strategy has been making in the business world, or maybe because of it, opposition has been rising.

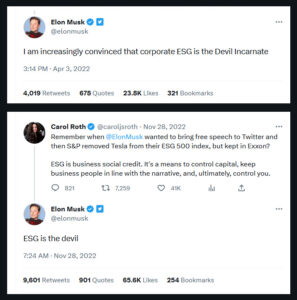

Carol Roth, author and small business advocate, wrote on Twitter that “ESG is business social credit. It’s a means to control capital, keep business people in line with the narrative, and, ultimately, control you.” Elon Musk, the head of Twitter, replied with a brief one-liner, “ESG is the devil”. Seven months earlier, Musk had written “I am increasingly convinced that corporate ESG is the Devil Incarnate”.[17]

Carol Roth, author and small business advocate, wrote on Twitter that “ESG is business social credit. It’s a means to control capital, keep business people in line with the narrative, and, ultimately, control you.” Elon Musk, the head of Twitter, replied with a brief one-liner, “ESG is the devil”. Seven months earlier, Musk had written “I am increasingly convinced that corporate ESG is the Devil Incarnate”.[17]

Various conservative media personalities, like Glenn Beck, have also criticized ESG. Beck’s wrote “Here’s how ESG scores work: Are you meeting the environmental, social, and governance standards that those in power deem are best for society? If not, then you become a risk and are locked out.”[18]

When companies score low on the ESG index, they are no longer eligible for ESG funding. The loss of ESG investment funds can be quite a motivator for corporations to “toe the line”. ESG is a way of bullying businesses into becoming a part of the “Woke capitalist” agenda. A company can be doing well in the business sector, but score a low ESG rating because it doesn’t adhere to Woke ideological demands. For example, Tesla (run by Elon Musk) was removed from the S&P 500’s ESG index, even though Tesla was performing well financially. Margaret Dorn, S&P Dow Jones Indices’ senior director and head of ESG indices, said that “While Tesla may be playing its part in taking fuel-powered cars off the road, it has fallen behind its peers when examined through a wider ESG lens.”[19]

Allen Mendenhall, a Professor at Troy University’s Sorrell College of Business, said “Many corporations pursue ESG merely for compliance purposes or under pressure from large asset management companies that use their proxy power to bully boards of directors.”[20]

Andy Puzder, a visiting fellow at the Heritage Foundation, said “The important thing to understand is you can no longer invest as you did in the past. … The firms that you used to trust to invest your funds as prudent investors are now acting as political activists, or even leftist crusaders.”[21]

BlackRock, State Street and Vanguard, the world’s biggest investment companies, known as the “Big Three” on Wall Street, control over $20 trillion in assets. They have become immensely rich and powerful, although not by creating physical wealth and prosperity, but by managing the money of others (such as retirement, mutual, and pension funds, along with investment accounts). Nonetheless, despite the parasitical nature of their wealth, feeding off the hard work of others, they are a major force in the financial world. The Big Three began pushing the ESG agenda, and, by their actions, were able to demand the obedience of the many firms that they invest others’ funds in.

Anson Frericks, who was an executive for Anheuser-Busch, wrote about the influence of the Big Three, and how they forced the aims of the Business Roundtable manifesto upon other companies:

“The Big Three began to issue guidelines on how they expected their portfolio companies to honor this ‘commitment’ by implementing so-called Environmental, Social, and Governance, or ESG, targets and scores

To encourage compliance, the Big Three uses their power as shareholders to influence who sits on corporate boards.

In 2021, they voted to replace Exxon Mobil board members with climate experts, who immediately sought to reduce the oil giant’s exploration and drilling output to meet contested climate goals.

They subsequently voted for ‘racial equity’ audits at companies like Apple and Home Depot, compelling the companies to impose race-based hiring criteria and implement diversity, equity and inclusion programs.

Beyond shareholder voting, The Big Three employ large engagement teams to pressure CEOs for progress on ESG goals and increased ESG scores.

… The Big Three also wield enormous influence when it comes to executive pay. According to one study, a shocking 73% of S&P 500 companies now tie executive compensation to ESG measures.”[22]

Bernard S. Sharfman commented that “no one person should have the power to act as the self elected czar of the capital markets. As we all know, such power ultimately does both political and economic harm to a country. It is perhaps time for a discussion of whether BlackRock has acquired too much power and what needs to be done about it.”[23]

The “Woke capitalism” of the corporate big boys is determined to change the face of our society, by bullying smaller companies to conform to their political agenda. These massive changes are being made without most people even knowing about it. The financial bully boys of Wall Street are changing our society without ever being elected by the populace to do so — entire nations are being manipulated by a small number of unelected corporate parasites, who are intent on pushing their anti-Western political agenda.

What should we do?

The CEOs of the “Big Three” are Larry Fink (BlackRock), Ron O’Hanley (State Street), and Tim Buckley (Vanguard). Each of these men need to be investigated for the role they have played in the undermining of Western society. The damage that they have caused to companies across the globe, and to societies around the world, is immeasurable. They need be held to account for the evils that they have been promoting, with their termite-like gnawing away at the societal structure of decent values and morality.[24]

There are two ways that the evil men of “woke capitalism” can be destroyed. Either via politics and legislation, with steps being taken against them in the political and legal arenas; or, they can be financially attacked, with campaigns created to stop all retirement funds from contributing to their companies, and to withdraw any other funds being held by those companies.

Interestingly, some steps have already been made in that direction. In October 2022 Louisiana initiated a plan to remove $US794 million from BlackRock, citing the company’s ESG practices. Shortly afterwards, Missouri removed $US500 million from BlackRock. Then, in December of the same year, Florida (under Governor Ron DeSantis) pulled $US2 billion of assets out from BlackRock.[25]

It appears that Tim Buckley, of Vanguard, has seen the writing on the wall, and has already started to distance his company from the active pushing of ESG investments.[26]

There are steps that we can take to combat Woke capitalists and their Leftist anti-Western agendas. Activists can complain to and lobby their elected representatives to disinvest from BlackRock; they can do the same with any funds which they contribute to (retirement funds, union funds, etc.). Patriots and nationalists can buy shares in companies which invest in BlackRock, and then create argumentative havoc at all shareholder meetings until they agree to disinvest. Anyone who has an investment portfolio, or who has control or influence over such a portfolio, should ensure that their funds are not helping BlackRock. There are all sorts of creative financial avenues that can be taken to fight back against the corporate tyrants.

The forces of evil need to be destroyed, and it is high time that we use all avenues open to us to take them down.

References:

[1] “Business Roundtable redefines the purpose of a corporation to promote ‘An economy that serves all Americans’”, Business Roundtable, 19 August 2019

[2] “Our commitment”, Business Roundtable

[3] “Our commitment”, Business Roundtable

[4] “One year later: Purpose of a corporation”, Business Roundtable, 19 August 2019

[5] “Advancing Diversity, Equity and Inclusion”, Business Roundtable

[6] “The Coca-Cola Company”, Business Roundtable

“Ford”, Business Roundtable

“PayPal”, Business Roundtable

“Microsoft”, Business Roundtable

“Walmart”, Business Roundtable

Links to the brief reports of various other companies on their “diversity” measures can be found at:

“Advancing Diversity, Equity and Inclusion”, Business Roundtable

[7] “Business Roundtable statement on the purpose of a corporation – two year anniversary”, Business Roundtable [2021]

[8] Lindsey Rae Gjording, “Larry Fink calls on CEOs to see their social responsibility”, DW (Deutsche Welle), 23 January 2018

Larry Fink, “A sense of purpose”, Harvard Law School Forum on Corporate Governance , 17 January 2018

[9] Andrew Ross Sorkin, “BlackRock’s message: Contribute to society, or risk losing our support”, The New York Times, 15 January 2018

[10] John Kehoe, “BlackRock’s Larry Fink says CEOs must do more than profit”, Australian Financial Review, 17 January 2018

[11] Alan Murray, “America’s CEOs Seek a New Purpose for the Corporation”, Fortune, 19 August 2019

[12] For general information about ESG, see:

Sandra Mathis and Craig Stedman, “Definition environmental, social and governance (ESG)”, TechTarget

Kyle Peterdy, “ESG (Environmental, Social and Governance): A management and analysis framework to understand and measure how sustainably an organization is operating”, Corporate Finance Institute

“What is ESG?”, Deloitte Central Europe

“What is ESG (Environmental, Social and Governance)?”, Diligent Corporation

Dan Byrne, “What is the history of ESG?”, Corporate Governance Institute, 21 October 2022

Dan Byrne, “Finance firms have ‘no choice’ on ESG”, Corporate Governance Institute, 12 October 2022

Kimberlee Josephson, “Why ESG ratings are like Netflix’s inventing Anna ”, American Institute for Economic Research, 4 April 2022

Kelsey Koberg, “What is ESG? Investing with environmental, social and governance in mind”, Fox Business, 27 September 2022

“Environmental, social, and corporate governance”, Wikipedia

[13] “What is Environmental, Social, and Governance (ESG) investing? What impact is your investment making?”, Investopedia, 22 March 2023

[14] “Why ESG is a new trend – an exclusive interview with Francis Menassa, JAR Capital”, FX Empire, 26 Jun 2019

[15] Lucy Pérez, Dame Vivian Hunt, Hamid Samandari, Robin Nuttall, and Krysta Biniek, “Does ESG really matter—and why?” (McKinsey Quarterly), McKinsey, 10 August 2022

See also: Kelsey Koberg, “What is ESG? Investing with environmental, social and governance in mind”, Fox Business, 27 September 2022

[16] Adele Ferguson, “The uncomfortable truth about ESG”, The Australian Financial Review, 14 March 2022

[17] “Remember when @ElonMusk wanted to bring free speech to Twitter and then S&P removed Tesla from their ESG 500 index, but kept in Exxon?”, Carol Roth (on Twitter), 28 November 2022

“ESG is the devil”, Elon Musk (on Twitter), 28 November 2022

“I am increasingly convinced that corporate ESG is the Devil Incarnate”, Elon Musk (on Twitter), 3 April 2022

Bradford Betz, “Elon Musk’s view of this investing strategy: ‘ESG is the devil’”, Fox Business, 28 November 2022

[18] “Here’s how ESG scores work”, Glenn Beck (on Twitter), 21 January 2022

[19] Lucas Manfredi, “Tesla removed from S&P 500’s ESG index; Musk responds”, 18 May 2022, Fox Business

Bradford Betz, “Elon Musk rips ‘environmental, social, and governance’ scores: ‘the devil’”, 27 November 2022, Fox Business

[20] Kelsey Koberg, “What is ESG? Investing with environmental, social and governance in mind”, Fox Business, 27 September 2022

[21] Kelsey Koberg, “What is ESG? Investing with environmental, social and governance in mind”, Fox Business, 27 September 2022

[22] Anson Frericks, “How YOUR 401k savings are being used to turn our biggest brands woke – as revealed by ex-Anheuser-Busch exec who shows how you can fight back at the cash registers”, Daily Mail, 28 May 2023

[23] Bernard S. Sharfman, [untitled comment], 17 January 2018; appended to: Larry Fink, “A sense of purpose”, Harvard Law School Forum on Corporate Governance , 17 January 2018

[24] “Larry Fink”, Wikipedia

“BlackRock”, Wikipedia

“Ron P. O’Hanley”, State Street

“State Street Corporation”, Wikipedia

“Mortimer J. Buckley”, Wikipedia [Mortimer J. Buckley is known as Tim Buckley]

“The Vanguard Group”, Wikipedia

[25] “BlackRock is caught in the ESG crossfire and struggling to get out”,

[26] Jordan Campbell, “Vanguard’s shift away from ESG fits with its focus on low fees”, Reason, 16 May 2023

Alan Goforth, “Vanguard defends ESG stance as critics launch TV ad campaign”, BenefitsPro, 4 April 2023

Tyler Hummel, “Vanguard’s message about ESG”, Leaders, 27 Feb 2023

Speak Your Mind